The tobacco market in Australia can be understood and quantified in a number of ways. Market share can be assessed either by looking at sales figures (from various industry sources, either by volume of products sold or by the value of products sold) or by looking at the proportions of smokers who regularly smoke various sorts of products (from surveys of smokers). Alternatively, the range of products available on the market, their producers, price segments and other characteristics, may be examined. Supplementary Table 10.7 lists factory-made cigarette (FMC) and roll-your-own (RYO) tobacco products available for sale in Australia at October 2022 by company, price segment, brand, pack size and variant (strength/flavour), and the date of introduction of that product. Table 10.7.1a and b summarise the FMC and RYO product markets, respectively.

At October 2022, there were 48 brands and sub-brands of factory-made cigarettes available on the Australian market. (Note: a sub-brand refers to a distinct range of products introduced under an existing brand family, such as the Winfield Jets sub-brand, introduced into the Winfield brand family.) Across those 48 brands, 304 unique variant and pack size combinations (products) were offered. British American Tobacco (BAT) Australia had the largest number of brands manufactured cigarette and product offerings, with 111 products across 19 brands/sub-brands. Imperial Tobacco had the highest concentration of super-value and value brands, with 95% of its 74 products within the ‘budget’ segment of the market. Approximately two fifths of Philip Morris’s 90 products were in the mainstream segment. Across all manufacturers, budget brands had much larger product ranges than premium products.

Buy Cigarettes In Australia

All three major companies offered products ranging in sizes from 20 to 40 sticks per pack, and BAT Australia and Imperial Tobacco offered products in 50 sticks per pack as well. Very large pack sizes were more common in super-value and value brands—see Supplementary Table 10.7. Premium brands were most often available in 20s, 25s and 30s across all tobacco companies.

Table 10.7.1a

Summary of the Australian factory-made cigarette market at October 2022, by tobacco company and market segment

| Company | Segment | Number of brands and sub-brands | Number of products (variant*pack size combinations) | Average number of products per brand/sub-brand | Average pack size of all products |

|---|---|---|---|---|---|

BATA: British American Tobacco Australia; IT: Imperial Tobacco; PM: Philip Morris; RE: Richland Express; Other: All other tobacco importers.

Source: CBRC checks of online supermarket and tobacconist websites and checks in-store in Melbourne, October 2022.

Table 10.7.b describes the 23 brands and sub-brands and 96 unique products available on the roll-your-own (RYO) tobacco market by manufacturer. British American Tobacco had the largest number of RYO unique products (38). RYO products were available in pouches ranging from 15 grams to 50 grams, with an average pouch size of 27.6 grams. However, the average pouch size of RYO products introduced from 2016 onward was 24.2rams, compared to 45. grams for those products that were available prior to 2012—see Supplementary Table 10.7 for more detail.

Table 10.7.1b

Summary of the Australian roll-your-own tobacco market at October 2022, by tobacco company

| Company | Number of brands and sub-brands | Number of products (variant*pack size combinations) | Average number of products per brand/sub-brand | Average pouch size of all products(g) |

|---|---|---|---|---|

BATA: British American Tobacco Australia; IT: Imperial Tobacco; PM: Philip Morris; RE: Richland Express; Other: All other tobacco importers.

Source: CBRC checks of online supermarket and tobacconist websites and checks in-store in Melbourne, October 2022.

Market share data are collected and analysed by a number of different market research groups. Data on sales in grocery stores is compiled by Retail World magazine and published annually in its end-of-year reports, based on a survey of supermarkets and grocery outlets about sales for previous 12 months up to the month of (roughly) September each year. The Nielsen group on the other hand compiles data on sales of products in convenience outlets. This is only occasionally published in publicly available sources. Euromonitor International compiles annual data on the total market across all outlets. Data on changes in market share over time for cigarettes of various tobacco blend, pack size and price segment are also compiled by Euromonitor and are available for purchase. Similarly, IBISWorld publishes reports on of the performance of major companies and industries in the Australian retail market.

Top Tobacco Retailer in Australia

10.7.1 Market share by company and brand: cigarettes

10.7.1.1 Sales figures relevant to market share

Cigarettes in Australia have almost exclusively been manufactured by three major industry groups: British American Tobacco Australia, Philip Morris Limited, and Imperial Brands. Several smaller tobacco importers have limited product ranges available in Australia, including Richland Express and Patron Group. Table 10.7.2 shows the market share of tobacco companies in Australia by cigarette volume in from 2012 to 2017. Over this period, market share for British American Tobacco and Philip Morris have steadily declined by 5-6% percentage points, while Imperial Brands increased market share by 11 percentage points, overtaking Philip Morris as the second largest cigarette company in 2017. Much of this increase occurred between 2013 and 2014. In 2017, BATA’s market share represented sales of 5.4 billion cigarette sticks, Imperial Brand’s market share represented 4.3 billion sticks, and Philip Morris’ market share represented 4.0 billion sticks. All other companies collectively represented 464 million cigarette sticks in 2017.

Table 10.7.2

Market share for cigarettes 2012 to 2017–16—by manufacturing company (% retail volume)

| Company | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Change 2012–17^ |

|---|---|---|---|---|---|---|---|

* Imperial Tobacco Group Plc renamed Imperial Brands Plc in 2016 (but still operates in Australia as Imperial Tobacco Australia).

^ Change in percentage points

Source: Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2019.5 Data up to 2017 available for purchase or on subscription: http://www.euromonitor.com/tobacco

Table 10.7.3 shows the leading cigarette brands in 2017, ranked by retail volume. In 2017, JPS continued to be the leading brand in Australia after overtaking Winfield in 2016.6 JPS was launched in Australia in 2009,7 and was one of the first super-value brands (i.e. low-cost relative to other brands) on the Australian cigarette market—see Supplementary Table 10.7.

Table 10.7.3

Cigarette brand rankings based on market share (volume), 2017

| Rank | Brand | Global Brand Owner |

|---|---|---|

Source: Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2019.5 Data up to 2017 available for purchase or on subscription: http://www.euromonitor.com/tobacco

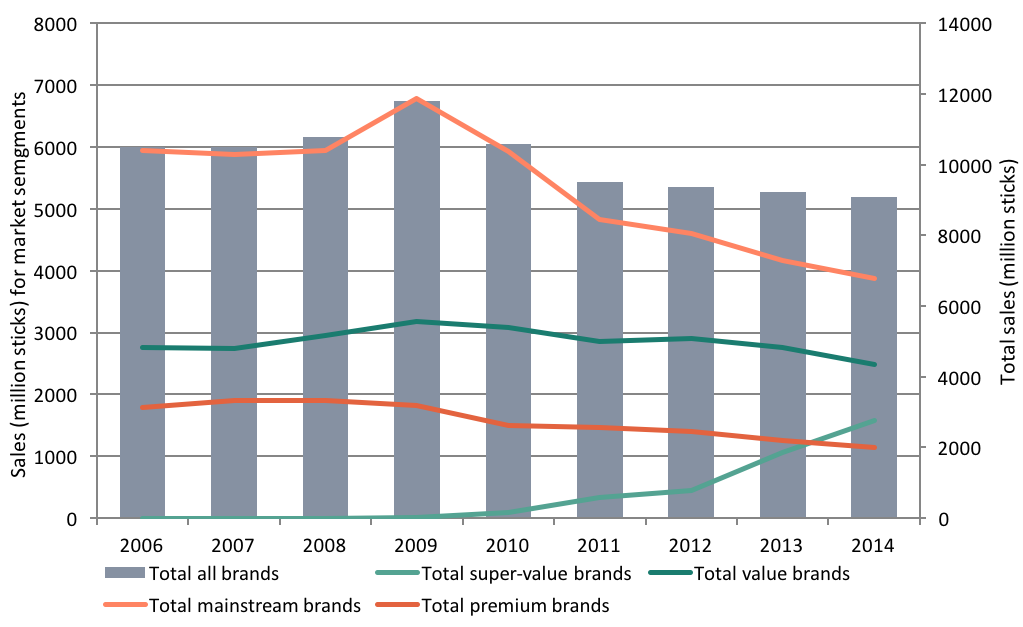

Super-value brands emerged on the Australian market in the late 2000s, and this fourth market segment rapidly grew in market share over the next five years. Figure 10.7.1 plots sales volume data from the grocery-only sector up to 2014, overall and by market segment. Since 2009, steady declines in sales of premium brands (including Alpine, Benson & Hedges, Dunhill, Marlboro and Peter Stuyvesant) and mainstream brands (including Winfield, Longbeach, Peter Jackson, Escort) can be observed. Sales of traditional value brands such as Horizon, Holiday, and Choice increased until about 2009, and then gradually declined in volume. Over this same period, several newly introduced super-value brands including Bond Street, JPS, and Rothmans rapidly gained market share, particularly from 2012 onward. In terms of volume, super-value brands overtook premium brands in grocery-only sales in 2014.

Figure 10.7.1

Grocery-only sales (millions of sticks) of premium, mainstream, value and super-value cigarette brands, 2006 to 2014

10.7.1.2 Survey data on cigarette brand preferences

While data on brand preferences among adults has been collected from surveys in Victoria and South Australia, neither the Australian Bureau of Statistics Health Survey or the Australian Institute of Health and Welfare’s National Drug Strategy Household Survey have asked about brand preferences, and so only limited data are available at the national level.

10.7.2 Market share by brand: roll-your-own tobacco

The Australian smoking tobacco market (including roll-your-own and pipe tobacco) is dominated by two major international tobacco companies, collectively accounting for about 95% of sales.5 Table 10.7.5 shows the volume market share of the smoking tobacco market by tobacco company from 2012 to 2017. In 2017 Imperial accounted for two-thirds of the volume of the smoking tobacco market. British American Tobacco’s share was 27.8%. Table 10.7.6 then shows the leading smoking tobacco brands (all roll-your-own brands) in 2017, ranked by volume.

Table 10.7.5

Market share for roll-your-own tobacco 2012 to 2017—by manufacturing company (% retail volume)

| Company | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Change 2012–17^ |

|---|---|---|---|---|---|---|---|

^ Change in percentage points

Source: Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2019.5 Data up to 2017 available for purchase or on subscription: http://www.euromonitor.com/tobacco

As of 2017, leading brands of smoking tobacco in Australia were Champion, Drum, White Ox, and JPS produced by Imperial Brands, and Winfield produced by British American Tobacco. These are all roll-your-own tobacco brands, not pipe tobacco.

Table 10.7.6

Roll-your-own tobacco brand rankings based on market share (volume), 2017

| Rank | Brand | Global Brand Owner |

|---|---|---|

Source: Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2019.5 Data up to 2017 available for purchase or on subscription: http://www.euromonitor.com/tobacco

10.7.3 Market share by brand: cigars

As with all tobacco products, cigars sold in Australia are imported, and the major Australian cigarette companies are not the only tobacco companies to have substantial engagement in the cigar market. Table 10.7.7 shows market share of cigars by tobacco company from 2012 to 2017. Scandinavian Tobacco Group has increased market share to almost 60%, almost double the next largest company, Philip Morris. Table 10.7.8 shows the leading cigar brands in 2017, ranked by volume.

Table 10.7.7

Market share for cigars 2012 to 2017—by manufacturing company (% volume)

| Company | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Change 2012–17^ |

|---|---|---|---|---|---|---|---|

^ Change in percentage points

Source: Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2019.5 Data up to 2017 available for purchase or on subscription: http://www.euromonitor.com/tobacco

Table 10.7.8

Cigar brand rankings based on market share (volume), 2017

| Rank | Brand | Global Brand Owner |

|---|---|---|

Source: Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2019.5 Data up to 2017 available for purchase or on subscription: http://www.euromonitor.com/tobacco

10.7.4 Market share by brand: cigarillos

As with cigars, the cigarillo market is also dominated by importers other than the major Australian cigarette and smoking tobacco companies. Cigarillos are ‘little cigars’, typically sold in packs of five or ten sticks. Some cigarillos are now sold in major supermarkets. Table 10.7.9 shows market share of cigarillos by tobacco company from 2012 to 2017. As with cigars, Scandinavian Tobacco Group dominated the market with more than 60% of volume, followed by Philip Morris with 26.3%. Table 10.7.10 shows the leading cigarillo brands in 2017, ranked by volume.

Table 10.7.9

Market share for cigarillos 2012 to 2017—by manufacturing company (% volume)

| Company | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Change 2012–17^ |

|---|---|---|---|---|---|---|---|

^ Change in percentage points

Source: Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2019.5 Data up to 2017 available for purchase or on subscription: http://www.euromonitor.com/tobacco

Table 10.7.10

Cigarillo brand rankings based on market share (volume), 2017

| Rank | Brand | Global Brand Owner |

|---|---|---|

Source: Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2019.5 Data up to 2017 available for purchase or on subscription: http://www.euromonitor.com/tobacco

Relevant news and research

For recent news items and research on this topic, click here. ( Last updated June 2022 )

References

1. Anon. Discussion with retail world staff, in Retail World2014.

2. Convenience & Impulse Retailing. Nielsen convenience and impulse sales report. Balmain, NSW: Berg Bennett, 2009. Last update: Viewed Available from: http://www.c-store.com.au/industry/acn/acn2009.pdf.

3. Euromonitor International. Tobacco in Australia − 2008 to 2013, Available for purchase. London: Euromonitor International, 2014. Available from: http://www.euromonitor.com/tobacco.

4. Thomson J. IBISWorld Industry Report F3606b: Tobacco Product Wholesaling in Australia. Melbourne, Australia: IBISWorld, 2018.

5. Euromonitor International. Tobacco in Australia—2016 and 2017. London: Euromonitor International, 2019. Available from: http://www.euromonitor.com/tobacco .

6. Euromonitor International. Tobacco in Australia. London: Euromonitor International, 2016. Available from: http://www.euromonitor.com/tobacco .

7. NSW Retail Tobacco Traders' Association. Price lists-cigarettes. The Australian Retail Tobacconist, 2009; 72(5 Aug-Sep):2-6.

8. Retail World. Annual Report 2014. Market sizes and shares. Retail World, 2014; December:30.

9. Retail World. Annual Report 2015. Retail World, 2015.

10. NSW Retail Tobacco Traders' Association. Retail Forum: What's new? Australian Retail Tobacconist, 2014; 81:4.

11. World R. Annual Report 2006. Market sizes and shares. Retail World, 2006; December:83.

12. World R. Annual Report 2007. Market sizes and shares. Retail World, 2007; (December):30.

13. World R. Annual Report 2008. Market sizes and shares. Retail World, 2008; December:30.

14. World R. Annual Report 2009. Market sizes and shares. Retail World, 2009; December:30.

15. World R. Annual Report 2010. Market sizes and shares. Retail World, 2010; December:30.

16. World R. Annual Report 2011. Market sizes and shares. Retail World, 2011; December:30.

17. World R. Annual Report 2012. Market sizes and shares. Retail World, 2012; December:30.

18. Retail World. Annual Report 2013. Market sizes and shares. Retail World, 2013; December:30.

19. Euromonitor International. Tobacco in Australia—2015 and 2016. London: Euromonitor International, 2017.